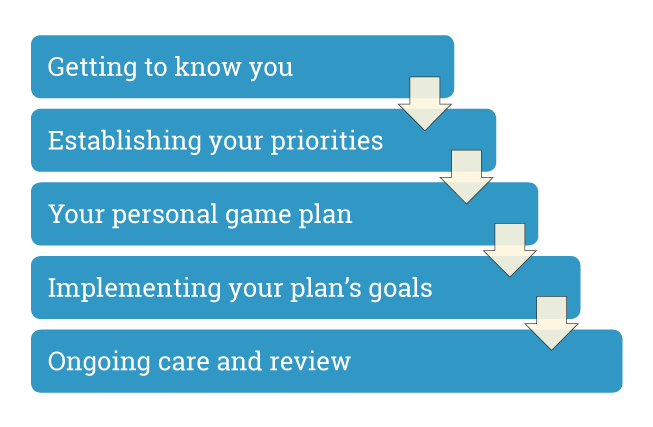

Step 1: Getting to know you

Our initial, complimentary consultation is designed to learn what your goals are for either starting a retirement plan or analyzing your current plan design and investments.

Step 2: Establishing your priorities

In our first meeting we’ll inquire about your employees’ understanding of the plan, deferral rates, and goals for the future. Are you trying to retain employees? Trying to save on taxes? Want supplemental financial education for your plan participants? Questions such as these point us toward the best options for your business.

Step 3: Your personal game plan

After reviewing your current vendor information, adoption agreements, fee disclosures and investment options, we’ll meet to discuss your current plan’s benchmarking and any recommended changes to the plan itself.

Step 4: Implementing your plan’s goals

Whether you’re satisfied or would like modifications to your plan, Legacy will leverage our expertise and access to the latest plan design software to ensure your employees are receiving the best available investment options. We’ll also work with your current vendors to implement any desired changes.

In addition, we’ll hold employee educations meetings to help your employees understand the importance of saving and the generous benefit the business is providing by offering your plan in the first place. Our goal is to increase participation by making the decision to get started simple and the process seamless.

Step 5: Ongoing care and review

Implementation of your plan is just the beginning. Throughout our relationship, you can expect to have access to a dedicated Retirement Plan Specialist who provides regular and proactive communication, prompt response to your questions or concerns, and individual attention to your goals. Continual monitoring of your plan will include investment meetings, quarterly check-in’s, updates on new hires, and plan testing reviews.

Ready to Learn More?

Schedule a Complimentary Consultation

Consultation Request

Please fill out this form and we will be in touch with you shortly.