Would you like to know how your benefits can work better for you and your family? Do you have questions about how financial assets outside AMC’s programs interact with your current benefits or impact your taxes and future retirement readiness? We’re here to help with those questions and more.

AMC has partnered with Legacy Financial Strategies to provide direct access to CERTIFIED FINANCIAL PLANNER™ practitioners so you can get your financial questions answered by an expert. Legacy’s advisors act in a fiduciary capacity, do not work on commission,and have no products to sell.

AMC’s associates will have access to webinars conducted by Legacy on various topics. They will also be available at the TSC for on-site workshops, consultations by appointment, and open hours for “stop-in” questions at no cost.

You may also engage more formally for financial planning or investment management. Legacy discounts their flat-fee financial planning costs as described below for AMC associates.

View the FAQ’s Under Two Video Series

View Other Frequently Asked Questions

Request a Free Consultation

Visit Our Blog

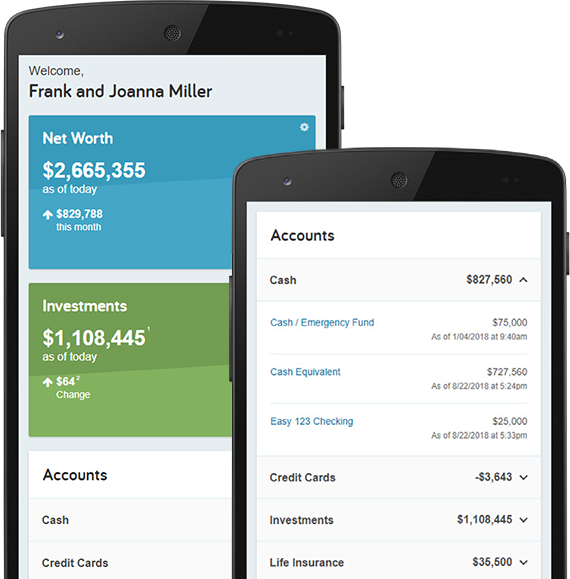

All Futureproofed associates have free access to their own eMoney portal. This site allows you to create your own financial headquarters and begin mapping out your journey toward any financial goal.

| Low Complexity | Moderate Complexity | High Complexity | |

|---|---|---|---|

| Income | Less than $100,000 | Between $100,000 and $200,000 |

More than $200,000 |

| Net Worth | Less than $100,000 | Between $100,000 and $1,000,000 |

More than $1,000,000 |

| Investable Assets | Less than $100,000 | Between $100,000 and $500,000 |

More than $500,000 |

| # of Goals | 1 | Up to 2 | Complex, or more than 2 |

| Annual Financial Planning Fee | $600 | $800 | $1,200 |

| Benefit (Cost) Paid by Employer | ($0) | ($0) | ($0) |

| Relationship Discount for first year | ($100) | ($100) | ($100) |

| Annual Associate Fee | $500 | $700 | $1,100 |

*Fees above waived for Asset Management clients reaching firm minimum and paying per schedule below

| Discretionary Investment Management (Tiered Annual Fee Schedule) | |

|---|---|

| $0 to $250,000 | 1.75% |

| $250,000 to $750,000 | 1.25% |

| $750,000 to $2,500,000 | 1% |

| $2,500,000 and up | .75% |

For clients just starting out or who prefer minimal face-to-face interactions, we offer Legacy Next, discretionary investment management via online platform with no transaction costs and low ongoing expenses. Legacy Next is available for account sizes between $5,000 and $500,000.